Just imagine, you wake up, have a good family time, and have a healthy breakfast, then you check your phone and suddenly realize that you have to pay a big amount, and the payday is too far to wait. What will you do at first? Not only you, but many people still turn to payday loans and get trapped with high interest rates and hidden fees.

But thankfully, in 2026, we have better solutions. We now offer a cash advance app, allowing borrowers to access instant money with a single click and at a lower cost. Platforms like MoneyLion have changed the way, but today’s market offers various tools designed to help you stretch your paycheck, avoid OD charges, and manage your budget more wisely.

If you are in search of a simple money app for quick advances or looking for the best cash advance apps that provide extra perks like budgeting and credit building, you are at the right place. Here are the top 12 trusted alternatives. Here are the options for apps like Earnin or apps like Dave, through which you can borrow smartly without the financial pitfalls of traditional payday loans.

What Is a Cash Advance App?

A cash advance app is a modern financial app that allows you to borrow a small amount of your upcoming paycheck before the actual payday. It is not like small payday loans online with no credit check, which actually have higher interest rates and strict repayment terms. But these apps are designed to provide short-term relief without pushing users into debt cycles. The following are the key benefits of using cash advance apps:

- Low or no interest rate: These apps mostly charge less or almost nothing compared to traditional lenders.

- Instant cash: The cash will be available typically within minutes or hours.

- Flexible repayment: The repayment will be automatically aligned with your paycheck schedule.

- Added features: Various platforms are not just loan apps, but they also offer budgeting tools, savings options, and even credit-building support.

The cash advance apps are trending currently because users are increasingly seeking safe, transparent, and digital-first alternatives to payday lenders. It gives you fast approvals, a user-friendly design, and financial wellness features; hence, they are nowadays a smart choice for handling unexpected expenses.

Why Avoid Payday Loans in 2026?

A payday loan is one of the risky forms of short-term borrowing. Though they are quick paycheck advances, they are the quick paycheck advance, but actually they are super costly. Many lenders charge APRs (annual percentage rates) up to 400%, which traps you in a debt cycle, or you can say a never-ending debt cycle. The following are some reasons to avoid payday loans:

- High APRs: High interest and hidden fees make repayment far more expensive than the OG loan amount.

- Debt Cycle Trap: Borrowers often take on a new loan to repay the old one, and continue the cycle. This creates a financial spiral that is really hard or near impossible to escape.

- Limited Flexibility: It is not like digital options; many payday loan apps have rigid repayment deadlines, which actually cause a debt cycle trap.

Some borrowing money apps instantly take minimal fees, have repayment flexibility, and offer you additional financial tools. They are designed to help users bridge short-term gaps without falling into the debt cycle trap.

10+ Best Cash Advance Apps Like MoneyLion

The following are the top 12 trusted payday advance apps, or apps that let you borrow money with a lower interest rate in 2026. Each app has unique features, benefits, and limitations to know before choosing the right instant cash advance app for your needs.

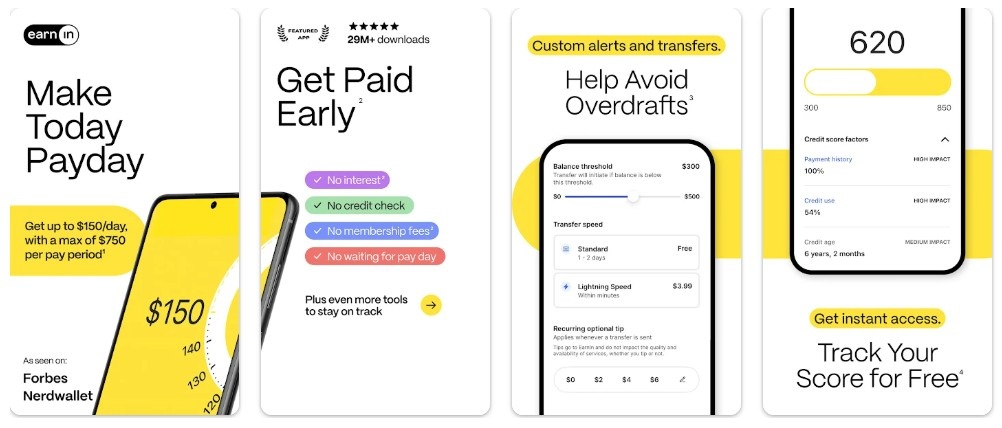

(1) Earnin

Earnin allows users to access $100 every day (and $750 per pay period) with no interest. The following is what makes apps like Earnin different:

- Voluntary ‘tips’ support the services; hence, there are no mandatory fees.

- Balance Shield alerts for low account balances, so you no longer have to check the balance manually every time.

- Strength: No credit checks required, no interest rate, just a transparent cash advance app model.

- Weakness: Relies on the tipping model; hence, the advanced limits can be restrictive.

- Users will get small advances quickly, and that too without any other costs.

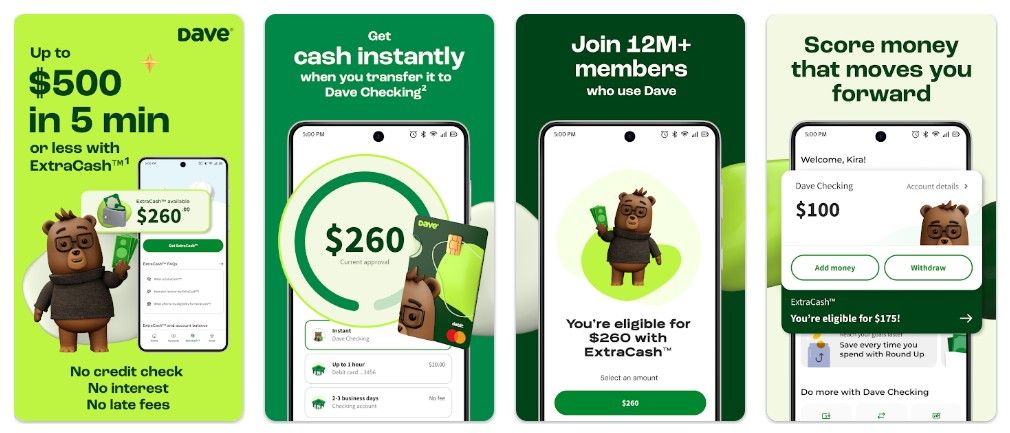

(2) Dave

Apps like Dave are known for their user-friendly design. The app gives you advances of up to $500. Other than that, the app:

- It has built-in budgeting and expense tracking tools.

- Gives you alerts for upcoming bills.

- Allow users to access up to $100 of earned but unpaid wages

- Strength: Offers you a big advance amount, and gives you the best financial planning tool

- Weakness: Takes a monthly membership fee.

- Dave is best for users who want both cash advances and budgeting tools for the long term.

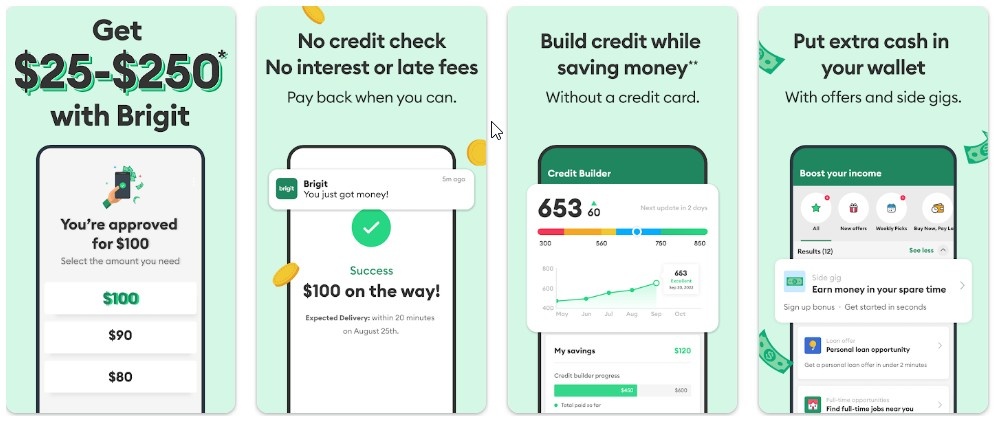

(3) Brigit

Brigit offers you a combination of cash advances with AI-powered financial insights. It also offers:

- Cash advance of up to $250.

- Credit-building subscription plan.

- Linked OD protection to your checking account.

- Strength: Strongly focuses on financial wellness and credit improvement tools.

- Weakness: Charge you a subscription fee

- Brigit is best for individuals seeking a proactive money management system.

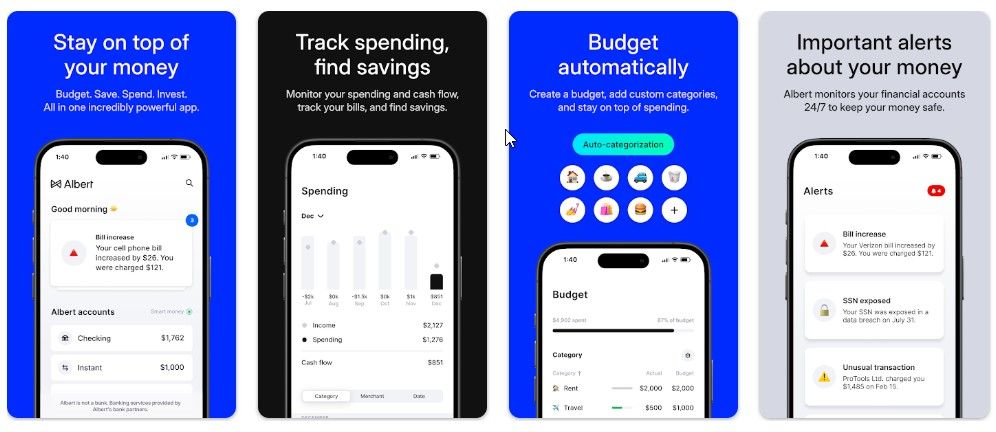

(4) Albert

The app offers you a blend of cash advances with investment and savings tools. The following is more about the Albert app.

- Get up to $250 advance with no late fees.

- Auto-saving and budgeting tools.

- Smart recommendations for spending.

- Strength: Takes no OD fees and works as a one-stop app for complete financial management.

- Weakness: You need to buy subscriptions to access some advanced features.

- This app is best for users who want a complete financial wellness app.

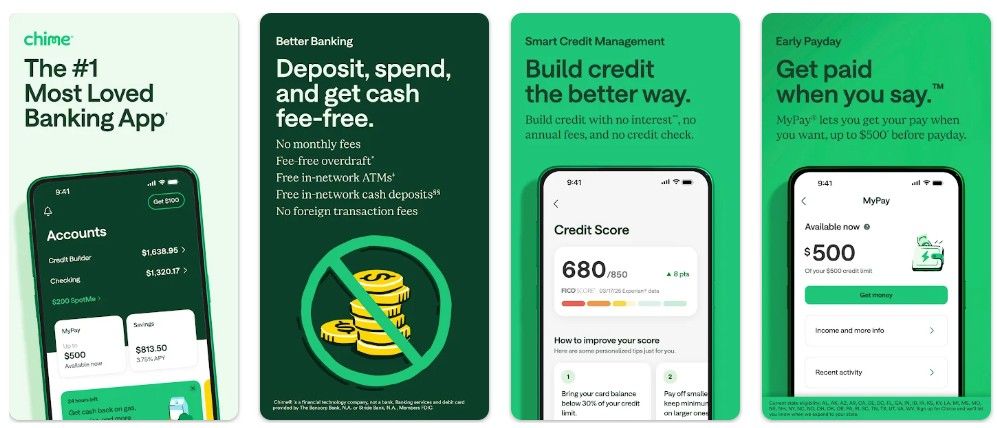

(5) Chime

The app offers early direct deposit access and no-cost banking facilities. The following are some features of the Chime app.

- You can access your paycheck up to two days early.

- No monthly maintenance or OD fees needed.

- FDIC-insured digital banking facilities.

- Strength: The app ensures transparency, safety, and no-cost banking facilities

- Weakness: Offers a limited cash advance amount compared to standalone apps.

- The app is best for digital banking users who want early access to their wages.

(6) Cleo

The app uses an AI chatbot to guide users financially while offering advances. The following is more about Cleo.

- Get up to $250 as advanced cash.

- Engaging AI chat for more financial insights.

- Offers budgeting and spending analysis as well.

- Strength: Offers you an interactive and engaging AI chatbot and quick cash access.

- Weakness: Not that useful for higher loan amounts.

- The app is best for younger users who enjoy AI-powered and conversational apps.

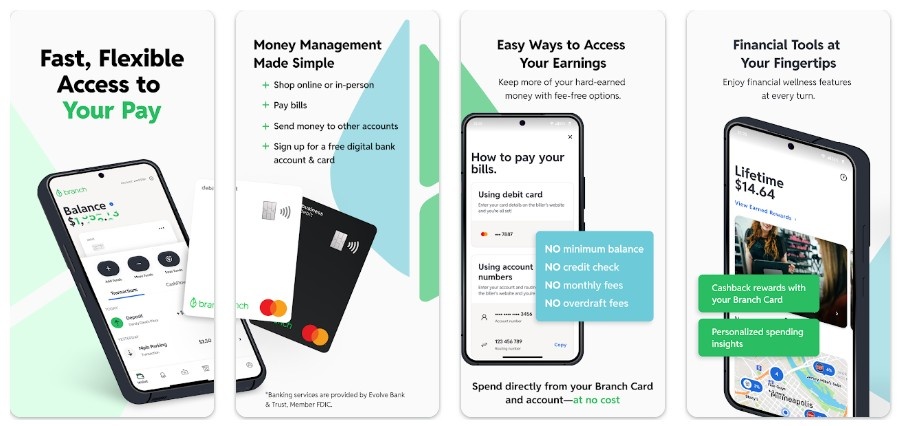

(7) Branch

The app works directly with users/employers to provide wage advances.

- The early wage access is tied to work shifts.

- Expense management tools.

- Instant payouts for gig workers.

- Strength: The app is ideal for hourly or gig workers, and it charges no interest rate.

- Weakness: Dependent completely on the employer’s integration.

- The app is best for gig workers and hourly employees who need early access to their wages.

(8) Klover

This app provides free cash advances supported by ad revenue.

- Get up to $200 as advanced cash.

- Get personalized offers and financial insights.

- No need for any credit checks or interest repayment.

- Strength: Ensures no-cost borrowing.

- Weakness: Heavy user experience due to too many ads.

- The app is best for users who want free access to cash without hidden fees.

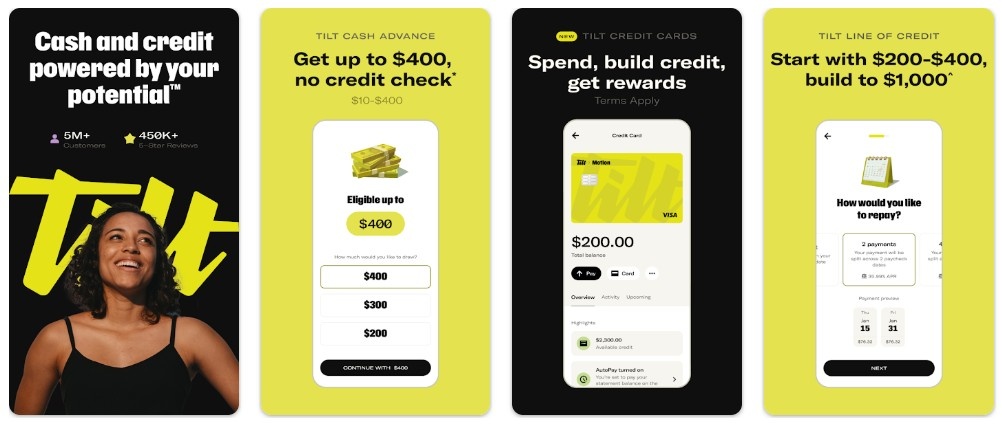

(9) Tilt (formerly Empower)

The app merges cash advances with long-term credit growth tools.

- Get up to $250 as advanced cash.

- Get automated budgeting and saving tools.

- Get credit-building features (subscription required).

- Strength: Offers short-term relief with long-term benefits.

- Weakness: You have to take a monthly subscription for credit-building features.

- This app is best for users who are looking to improve their credit while borrowing a large amount.

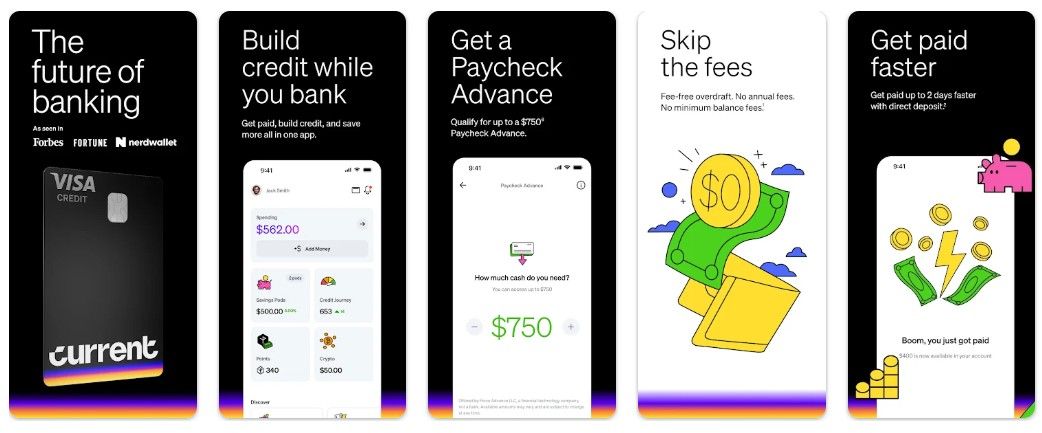

(10) Current

Current is a neobank that offers early paycheck deposits.

- You can get payment up to two days early.

- The app has integrated savings pods and spending insights.

- Users will get FDIC-insured accounts.

- Strength: Get banking and early access from a single app.

- Weakness: The advanced limits are lower than those of dedicated apps.

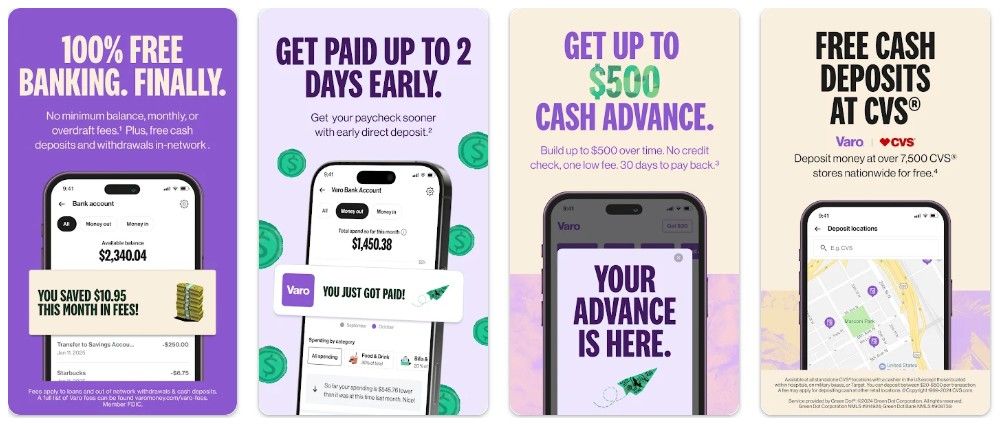

(11) Varo

This app provides a solid balance between banking and lending.

- Get cash advances up to $500.

- No credit checks or hidden fees.

- FDIC-approved online bank.

- Strength: Higher advance amounts than most apps.

- Weakness: Needs a qualifying account and deposits.

- This app is best for users who want larger advances without traditional lending hurdles.

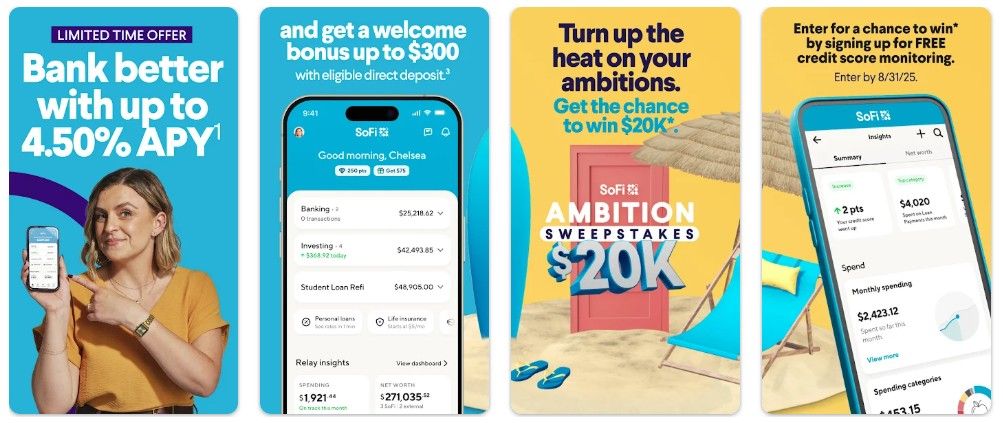

(12) SoFi Money

The app combines banking services with low-fee cash advances.

- Cash advance options with transparent fees.

- Integrated investing and saving products.

- The app ensures strong customer support.

- Strength: Ensures comprehensive money management.

- Weakness: You need a SoFi membership.

How India App Developers will Help You Build a Cash Advance App like MoneyLion

Not only proven technical expertise, but building an app like MoneyLion demands industry expertise, compliance knowledge, and a better understanding of your end-users’ expectations. India App Developer have hands-on experience building secure and scalable new cash advance apps. The following is how we can help you:

(1) Custom Solutions

We have hands-on experience in designing systems that enable same-day cash advance functionality and ensure users get funds quickly, without any hassles. Also, we have designed APIs with real-time payroll integration, including quick account verification to process transactions smoothly and reliably.

(2) Flexible Lending Models

We have built a platform that supports different loan structures, including instant cash loans and controlled credit lines, too. Using these apps, businesses can set custom borrowing limits and repayment schedules based on individuals’ profiles.

(3) Secure and compliant Development

We offer robust encryption and authentication protocols to protect the sensitive financial data of individuals. The compliance ensures the app can safely lend money until payday.

(4) Advanced Features

We ensure providing custom-based advanced user features, including budgeting tools, spending insights, and AI-driven financial coaching to manage payday loans till payday. We also have experience in integrating subscription models or ad-supported experiences.

(5) Seamless UX

We believe in offering mobile-first design, which is optimized for performance and usability. We promise intuitive onboarding, making it easier for users exploring apps to borrow money for the first time.

(6) Scalable App

We provide cloud-based architecture to handle high transaction volumes. Also, the built-in analytics dashboards allow business owners to track the performance, risk, and user behavior.

India App Developers have proven work experience in fintech and mobile banking app development, and build custom solutions to meet both startup and enterprise needs. We also provide ongoing maintenance and feature upgrades as part of our post-deployment services, which keep your app ahead in the competitive market. So, what are you still thinking? If you are looking for a trusted technology partner and not just a mobile app developer to build a cash advance app like MoneyLion, let’s have a virtual coffee and discuss your ideas.

FAQs

How much does it cost to develop a cash advance app like MoneyLion?

The cost to develop a cash advance app depends on the complexity and features of the app, but you can consider approximately $40,000 and more for a mid-scale financial app.

How much time will you need to build a cash advance app?

Approximately, it will take 4 to 6 months to develop a mid-scale cash advance app, which includes market research, UI/UX design, development, testing, and deployment.

Which tech stake do you recommend to build a secure and scalable cash advance app?

We highly recommend React Native/Flutter for mobile, Node.js/Python for backend, and AWS or Google Cloud for secure hosting.

Are you comfortable signing an NDA for a security purpose?

Yes, we are comfortable signing an NDA for confidentiality and security of the data of your project.

What type of maintenance and post-deployment services do you offer?

We offer ongoing maintenance of the app that includes bug fixing, performance optimization, feature scalability, and security updates.