Introduction:

In today’s rapidly evolving digital landscape, financial technology, commonly known as fintech, has become a transformative force within the financial industry. These innovative fintech Mobile App Development South Africa are reshaping how we handle our finances, facilitate transactions, and interact with banking services.

If you’re contemplating the development of a fintech application specifically tailored for South Africa, this all-inclusive guide is here to assist you every step of the way. With a meticulous breakdown of the process, this guide will ensure that your app development journey in the country is not only successful but also leaves a lasting impact.

What is Fintech? How is it Shaping the Future of Payments?

Fintech refers to the innovative technology that is transforming the financial sector. This word refers to a broad category of financial offerings, including mobile payments, internet banking, P2P lending, money transfers, and investment management. Since fintech provides customers with unprecedented ease, accessibility, and efficiency, its popularity has skyrocketed. The future of payments will be drastically altered as a result of its ability to streamline financial transactions, cut down on associated fees, and increase access to credit. The introduction of fintech has opened the door to a more unified and accessible financial system.

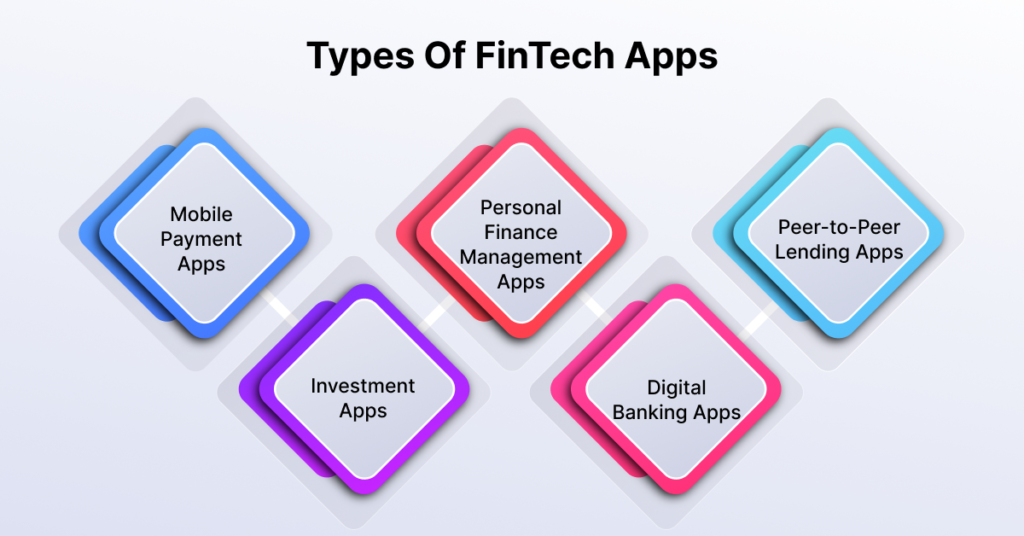

Types Of FinTech Apps:

- Mobile Payment Apps: These apps enable users to make secure payments using their smartphones, eliminating the need for cash or physical cards.

- Personal Finance Management Apps: These apps help users track their expenses, create budgets, and gain insights into their financial health.

- Peer-to-Peer Lending Apps: These apps facilitate lending and borrowing between individuals, bypassing traditional financial institutions.

- Investment Apps: These apps make it simple for users to put money into various financial assets like stocks, bonds, cryptocurrencies, and more.

- Digital Banking Apps: You can do everything from manage your finances and make transfers to paying your bills with the help of these applications.

Features of Fintech Apps:

- Security: Fintech apps must prioritize user data protection, implementing robust encryption, secure authentication methods, and fraud detection mechanisms.

- User-Friendly Interface: The application’s usability is greatly enhanced by intuitive and user-friendly interfaces, which enable users to easily navigate and access the desired functionalities.

- Seamless Integration: Fintech apps should seamlessly integrate with existing financial systems, enabling smooth data synchronization and interoperability.

- Personalization: Tailoring the app experience to individual users’ preferences and needs enhances engagement and fosters customer loyalty.

- Real-Time Notifications: Push notifications and alerts keep users informed about their financial activities, account updates, and security-related information.

What to Consider Before Developing a FinTech App?

Before diving into fintech app development, it’s essential to consider the following factors:

- Market Research: Conduct thorough market research to identify the target audience, analyze competitors, and understand user preferences and pain points.

- Compliance and Regulations: Comply with the regulatory frameworks and security standards set by the relevant authorities to ensure legal and secure operations.

- Scalability: Plan for scalability from the initial stages to accommodate future growth and increasing user demands.

- User Experience: Prioritize user experience by focusing on simplicity, speed, and convenience in app design and functionality.

- Monetization Strategy: Define a monetization strategy, whether through subscription models, in-app purchases, or partnerships with financial institutions.

Top FinTech App Development Trends in 2023:

- Artificial Intelligence (AI) and Machine Learning (ML): Implement AI and ML technologies to enhance fraud detection, personalized recommendations, and chatbot assistance.

- Biometric Authentication: Utilize biometric authentication methods like fingerprint and facial recognition for secure and seamless user authentication.

- Blockchain Technology: Explore the potential of blockchain for secure and transparent transactions, decentralized finance, and smart contracts.

- Voice-Based Banking: Incorporate voice recognition and voice-enabled commands to provide hands-free and convenient banking experiences.

- Open Banking: Embrace open banking APIs to enable collaboration with third-party financial service providers and offer enhanced services to users.

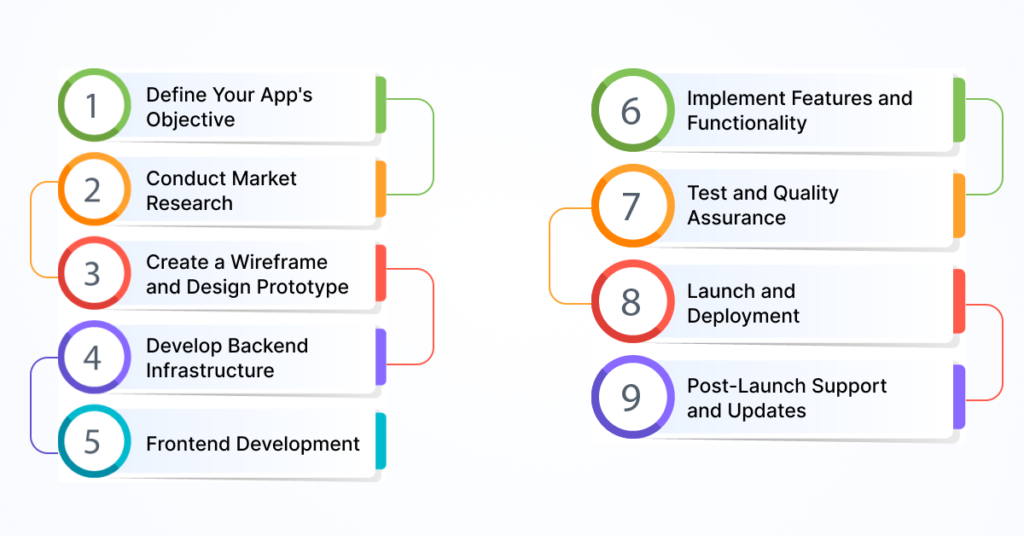

Step By Step Guide On How To Create A FinTech App:

- Define Your App’s Objective: Determine the core purpose and target audience of your fintech app.

- Conduct Market Research: Identify market gaps, analyze competitors, and validate your app idea.

- Create a Wireframe and Design Prototype: Visualize the app’s structure and flow through wireframes and create a design prototype.

- Develop Backend Infrastructure: Build a robust backend infrastructure to handle data storage, security, and integration with external systems.

- Frontend Development: Create the app’s user interface (UI) and user experience (UX), providing an intuitive and visually appealing design.

- Implement Features and Functionality: Integrate the necessary features and functionalities, such as payment gateways, data analytics, and user management.

- Test and Quality Assurance: Conduct extensive testing to confirm the app’s performance, functionality, security, and device compatibility.

- Launch and Deployment: Prepare your app for launch by submitting it to the relevant app stores and ensuring a seamless deployment process.

- Post-Launch Support and Updates: Provide continuous support, address user feedback, and release regular updates to improve app performance and add new features.

How Much Does It Cost To Build A FinTech App?

The cost of developing a fintech app depends on various factors, including complexity, features, platform compatibility, and development team rates. In general, it is best to engage with an experienced app development company that can provide a precise pricing estimate based on your individual needs.

Develop Your Next Fintech App with India App Developer:

If you’re looking for a reliable and experienced app development partner for your fintech app, consider collaborating with India App Developer. With a team of skilled professionals, they offer comprehensive mobile app development services in South Africa, tailored to your unique business needs. From conceptualization to deployment, India App Developer ensures a seamless app development journey.

Also Read : How to Create an App

Conclusion:

Developing a fintech Mobile App Development requires careful planning, thorough research, and expert execution. You can create a successful and effective fintech app that fits the shifting needs of the market by following the step-by-step guide provided in this article and taking into account the newest trends and user expectations. Embrace the opportunities offered by fintech, and empower users with convenient, secure, and innovative financial solutions.